Welcome to SaverLife

Finances 101

When you think about financial health, what comes to mind? For SaverLife members, defining financial health can look very different to each person. Why? Because there’s no one way to navigate your financial situation: everyone is working toward different goals for themselves and their families. This is also true of entrepreneurship. Starting and maintaining gig…

Are you looking to start gig work or become an influencer? Welcome to the SaverLife microentrepreneur community! Through surveys and interviews, we’ve found that a majority of SaverLife members are pursuing gig or influencer work to make ends meet and increase their monthly income. In some cases, they’re also planning to transform this work into…

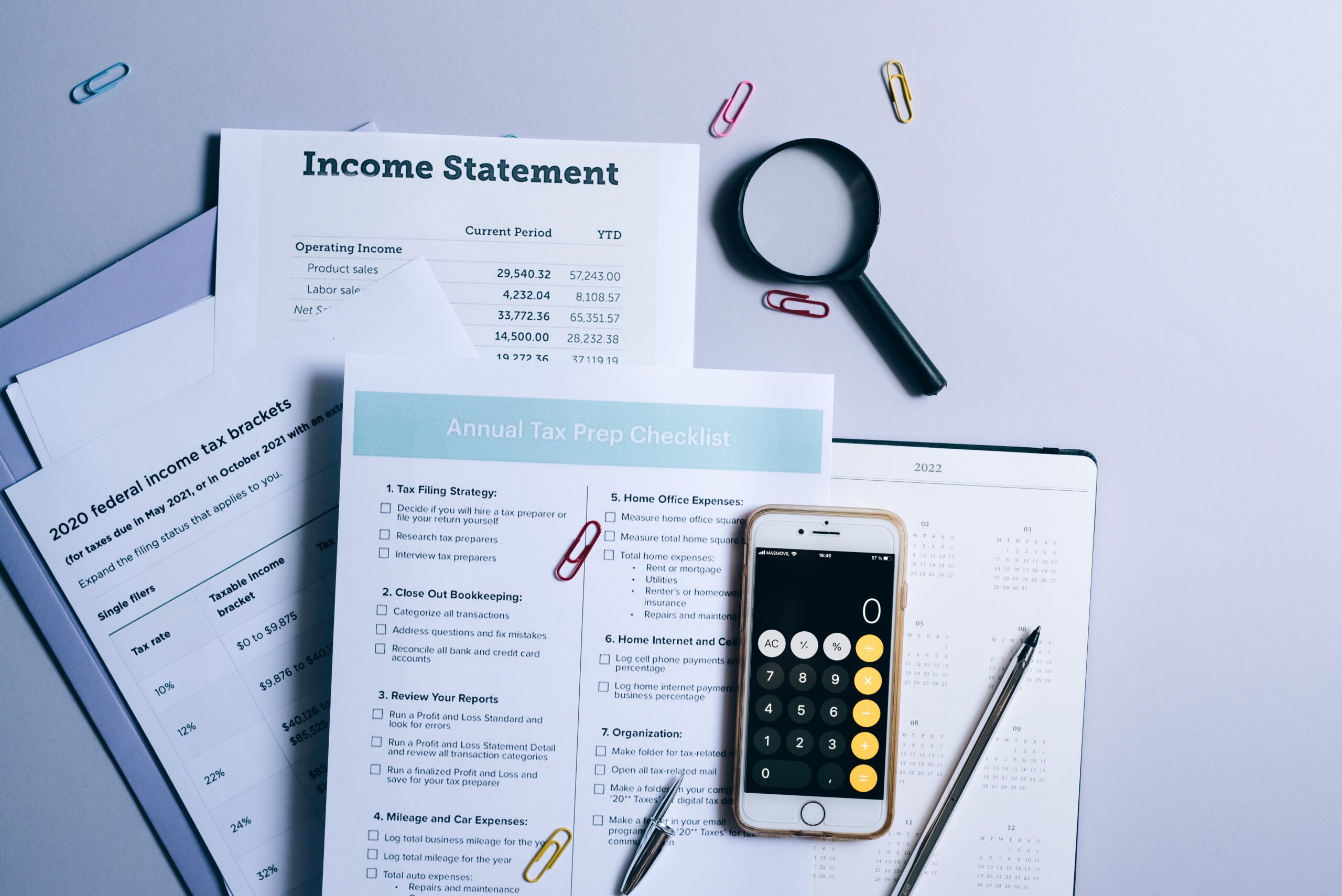

Being your own boss comes with many benefits, like greater flexibility, freedom, and control over your work. However, when it comes to taxes, being self-employed can feel like a whole new ballgame. Navigating the process of self-employment taxes, including what they are, who needs to pay them, and when they’re due, can be tricky and…

Are you thinking about starting a side hustle to supplement your income? Through ongoing interviews and surveys, SaverLife has learned that many members pursue additional work on top of their primary jobs to make ends meet and take steps toward the...

Are you providing regular care to a family member or friend? If you’re receiving compensation for your services, it’s important to track your income. Caregiving, even for a loved one, could be considered self-employment and change how you file your...