The National Bureau of Economic Research (NBER) is the organization that decides if the US is in a recession. They define a recession as “a significant decline in economic activity that is spread across the economy and lasts more than a few months.” So, what the heck does this mean? In a recession, companies are making less stuff because people are buying less stuff, which means companies aren’t hiring as many people to make stuff, so fewer people have jobs.

Recessions are not uncommon; since 1854, the U.S. has gone into recession about once every five years. The average recession going back to the 1850s lasted for about 18 months.

During every recession (this is my third as a financial professional), the news seems to say the same thing: “This time is different,” and the US economy will “never” recover. The U.S. economy has survived a civil war, multiple world wars, various political climates, the Spanish Flu, and domestic attacks on our nation (Pearl Harbor and the World Trade Center attack). We can and will survive a recession.

The following are four steps you can take NOW to prepare and survive a recession.

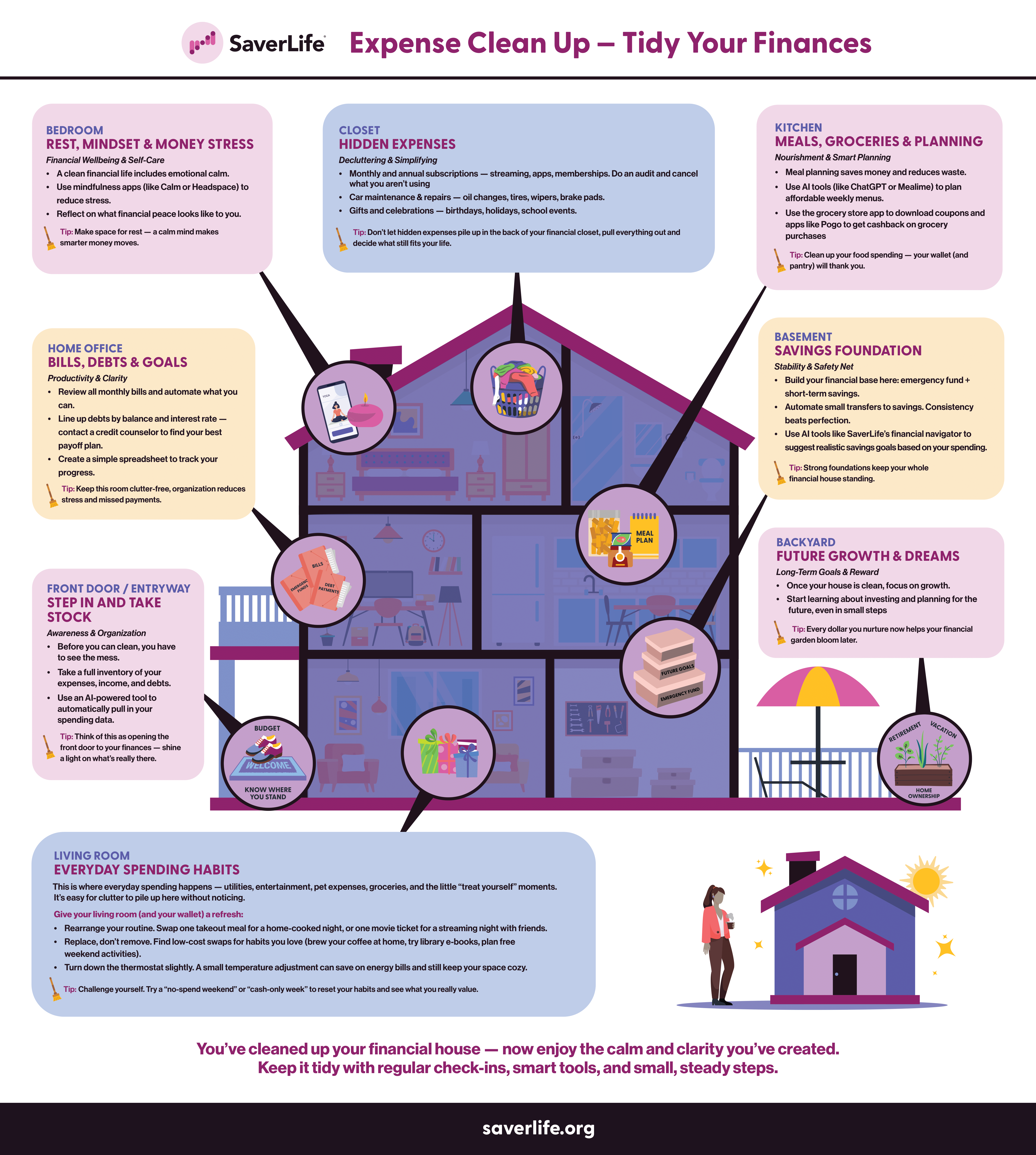

1. Create a “Crisis Budget”

You create a crisis budget by listing the essential expenses you need to pay monthly to survive a drop in income- such as food, shelter, and transportation. You can exclude costs you know you will ditch if you lost your job.

2. Focus on Saving

If you are facing a loss or a drop in income, any extra money, no matter the amount, should go toward savings. SaverLife offers a ton of great resources to help you save money.

3. Contact Your Creditors

If you are facing a job loss or drop in income, call your creditors now. Contact your creditors as soon as possible to let them know of a possible change in your income, even if you can pay your bills. Creditors are more likely to work with you if you contact them before there is a problem.

4. Have Grace

At the time of this writing, our nation seems to be facing one crisis after another: COVID-19, the outcry over racial injustice, natural disasters, and a challenging election season. You throw in a job loss, and you may find your temper shorter than normal. Talk to your kids about their worries and explain any changes you may have to make. Talk to your partner because sometimes fear comes out as anger. If you are stressed, get help.

The best way to manage a recession is to manage your finances. Taking the steps above will help you manage life financially during a recession.